September 2025

Anneliese Molina ready to greet BFG clients in Hannibal.

/BFG Spotlight - Anneliese Molina

Anneliese Molina, a client service specialist in Hannibal, juggles front desk responsibilities, leads team huddles, prepares conference rooms—and always seems to know exactly when someone needs an extra word of encouragement.

"I just love customer service and working with people,” she said. “Building relationships with clients and getting to know them is what I love most about work."

When her bright smile greets those walking into the Hannibal office, clients immediately know they belong. And she is exactly where she belongs too.

One of the youngest members of the BFG Team, Anneliese has spent the last several years navigating her early adult life and career. Although He has led her down some unexpected paths—God has proven the ultimate guide to a future that only He could have led her to.

Growing up in Chillicothe, Mo., Anneliese transferred to Hannibal-LaGrange University in 2021 after earning her associate’s degree from North Central Missouri College, joining her older sister Brie.

It was the first leg of a journey she was initially reluctant to take. When Brie first suggested to Anneliese they attend school together in Hannibal, Anneliese immediately dismissed the idea.

"I honestly thought, ‘There’s no way I can do that,’ but somehow it all came together,” Anneliese said. “Within the next couple of weeks, we were going through the admissions process and touring the campus.”

After finishing their first year, health issues prevented Brie from returning to HLGU, and Anneliese returned to campus alone. When she earned her bachelor’s in business administration with an emphasis in management and entrepreneurship, Anneliese looked forward to returning home to her family in Chillicothe.

The third of four children in a pastor’s family, Anneliese’s love for her parents and siblings shined as she discussed her relationship with each one. With faith at their center, David and Jacqui Molina taught their children to trust God above all else.

So, when God began nudging Anneliese to stay in Hannibal, choosing to live hours away from home was hard—but she listened. Although much of her heart remained in Chillicothe, God continued providing for Anneliese in Hannibal, giving her swift confirmation at every step.

When looking for permanent housing, Anneliese unexpectedly found Desiree Brown, a coworker she was just getting to know. What started as a lighthearted idea turned into a living arrangement and friendship that Anneliese now sees as one of God’s sweetest provisions.

“I made a joke to her one day, like, ‘It’d be funny if we lived together.’ And then we both stopped and thought—why not?” Anneliese said. “Before we knew it, everything was clicking into place.”

Shortly after, Anneliese requested to go full time at the bank, and although there weren’t openings available, the bank offered her a spot anyway. With a roommate and job in place, she was grateful—but God had something else entirely waiting on the horizon.

Just before receiving the bank’s offer, Anneliese’s phone rang with a call from Jason Nichols, director of operations at Benson Financial Group. Based on a recommendation from BFG advisor Ben Strother, her former HLGU professor, Jason asked to meet with Anneliese.

Just two days later, she found herself sitting across from Jason Nichols and Connie Benson in a booth at Mimi’s Coffeehouse. The meeting felt less like an interview and more like an answered prayer.

As Jason and Connie described the culture at BFG, Anneliese knew God had arranged this surprise opportunity. While Anneliese loved her job at the bank, she longed to share her faith more openly at work and serve clients on a deeper level.

“I’d barely heard of Benson Financial Group at the time,” she said, with a laugh. “Now I see God was opening a door that I didn’t even know was there. I accepted the job immediately—I didn’t need time to think about it.”

As a client service specialist, Anneliese’s smile is more than a simple greeting. From their favorite refreshments to their special days, or even their hardest ones—she learns who BFG clients are and anticipates what they need, often before they walk in the door.

“I have such a deep reverence for the foundation at BFG and I want to reflect that,” she said. “It’s about more than respecting the culture here—it’s that I want to honor what Pat and Connie have built, because it’s so special.”

She has also found a second home at BFG, and a family who she knows she can count on—beyond work hours.

"Living away from my family, I’ve had to learn to rely on other people—and that’s been hard for me,” she said. “But this has become a second family, who I know I can count on anytime. It’s also given comfort to my parents, knowing that I'm with people who trust in the Lord and who will have my back.”

In the journey, Anneliese often turns to this verse:

Trust in the Lord with all your heart and lean not on your own understanding. Acknowledge Him in all your ways, and He will make straight your paths. -Proverbs 3:5-6

“I didn’t know what the Lord had in store for me, and I didn’t know what to expect,” she said. “I just knew I couldn’t lean on my own understanding, and I am grateful for that.”

/The Power of a 529 College Savings Plan

by Tim Miller, BFG Financial Advisor

When it comes to preparing for college costs, few tools are as effective, or as underutilized, as the 529 College Savings Plan. Whether you're a parent, grandparent, or simply someone looking to help a loved one with education expenses, a 529 plan can offer significant advantages, especially for residents of Illinois and Missouri.

What Is a 529 Plan?

A 529 plan is a tax-advantaged investment account designed specifically for education savings. Funds can be used for a wide range of qualified expenses, including tuition, fees, books, supplies, and even room and board.

Recent changes within the One Big Beautiful Bill Act (OBBBA) have expanded uses to include up to $20,000 annually for K–12 tuition and certain apprenticeship programs.

Additionally, through the Secure Act 2.0, unused funds (up to a limit) can now be rolled into a Roth IRA under specific conditions. This adds flexibility for our Benson Financial Group families worried about overfunding a 529 plan.

Why Illinois and Missouri Residents Have an Edge

Both Illinois and Missouri offer their own state-sponsored 529 plans. Bright Start in Illinois and MOST 529 in Missouri. These plans come with some notable perks:

- State Tax Deductions: Illinois residents can deduct up to $10,000 per individual (or $20,000 for married couples) in contributions from their state income taxes each year. Missouri offers similar deductions. Up to $8,000 per individual ($16,000 for married couples).

- No Residency Requirement for Beneficiaries: One misconception is that you must use your 529 account in the state where it is from. That’s not correct. You don’t have to use the plan in your home state. For example: A child can live in Missouri, have a Bright Start account in Illinois, and attend college anywhere in the country.

Tax Advantages and Long-Term Growth

The biggest draw of a 529 plan is tax-free growth. Contributions grow tax-deferred, and qualified withdrawals are completely free from federal and often state income taxes. That can result in significant savings over the life of the plan, especially if you start early and invest consistently.

529 Plans and Estate Planning

529 plans also offer powerful estate planning benefits. Contributions qualify for the annual gift tax exclusion (currently $19,000 per beneficiary), and a special rule allows you to "superfund" a 529 by contributing five years’ worth at once ($95,000 for individuals or $190,000 for couples) without triggering gift taxes. This allows high-net-worth families to remove substantial assets from their taxable estates while still retaining control over how the money is used.

Common Misconceptions

Some families worry about “locking in” their money or losing it if the child doesn’t attend college. The truth is, you can always change the beneficiary to another family member, or even yourself. And with the recent Roth IRA rollover provision, which started in 2024 as part of the Secure Act 2.0—there are now more ways than ever to put unused 529 funds to good use.

Final Thoughts

Whether you're just starting to save or looking to fine-tune your existing strategy, a 529 plan remains one of the most flexible and tax-efficient tools available for education funding. With strong state incentives in Illinois and Missouri, there's no better time to take advantage of this opportunity. We encourage you to reach out to your Benson Financial Group, Financial Advisor, for any other questions.

Prior to investing in a 529 Plan investors should consider whether the investor's or designated beneficiary's home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in such state's qualified tuition program. Withdrawals used for qualified expenses are federally tax free. Tax treatment at the state level may vary. Please consult with your tax advisor before investing. (19-LPL).

/BFG Team Members attend LPL Conference in San Diego

In August, members of the Benson Financial Group attended the annual LPL Financial Conference. The event draws nearly 10,000 financial professionals and staff from around the country.

For Justin Gibson, part-owner and financial advisor at BFG, said the event highlighted a bright future with continued growth for LPL Financial. LPL Financial CEO Rich Steinmeier spoke to the crowd on the theme “What If You Could?” discussing innovative upgrades the company has invested in.

“It’s important for us to hear how a company we are affiliated with is doing but also get industry insights from a higher level,” Just said. “It was great to hear from the CEO, he seems really personable and down to earth.”

The team also enjoyed in-person meetings with several LPL professionals they regularly work with over the phone and learned from several hundred industry-related vendors about new companies and technology.

While Justin enjoyed the professional and educational opportunities offered at the conference, he was even more grateful for relationship-building time with the team.

“When we travel together, we take advantage of the time away from the office to do non-work-related activities too. We find tours to take, eat together, and so on,” he said. “This sweet down time builds lasting bonds that are so important professionally—but also personally.”

BFG Team members at the LPL Conference in San Diego. From left: Jen Kovar, Kristina Corzatt, Jeriod Turner, Justin Gibson, Kenton Snyder, and Tim Miller.

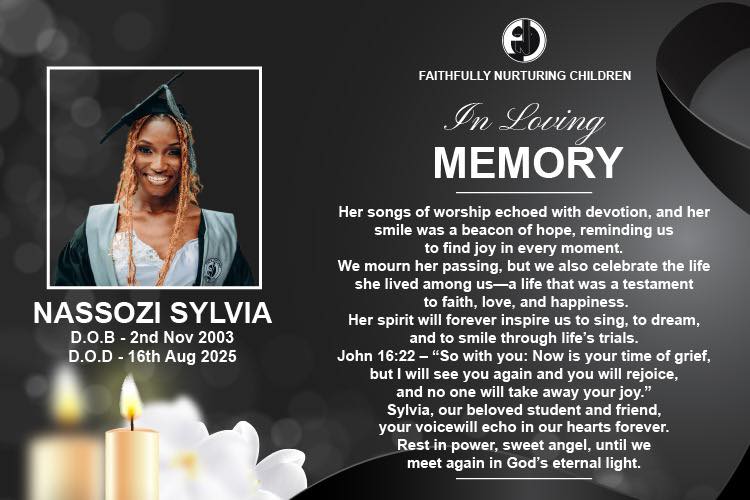

/We Mourn the Passing of FNC

Academy Graduate

Benson Financial is deeply saddened to share the loss of Nassozi Sylvia, a recent graduate from Faithfully Nurturing Children Academy (FNC), a school for children in Kampala, Uganda to earn an education and learn about the love of Christ.

Sylvia lost her battle with Tuberculosis on Saturday, August 16, 2025.

Sylvia was part of the first FNC graduating class in January, to which several BFG team members traveled to Uganda to attend. BFG has been part of supporting FNC since it was founded.

Known to bring beautiful songs of hope and joy in the Lord, Sylvia was a bright light and dearly loved sister to her FNC family.

We at BFG mourn this great loss alongside FNC, and find great comfort that Sylvia is now resting in the arms of Jesus.

Announcements

/Congratulations, Steve Hill!

Benson Financial Group congratulates Steve Hill, retired BFG financial advisor, on the release of his book, The Choice Behind All Other Choices: A Study of Genesis 1-3.

In The Choice Behind All Other Choices, Steve Hill invites readers to shift their focus from the how and when of creation to the deeper questions Genesis was always meant to answer: Who is God? Who is man? Why are we here, and what does God desire for us?

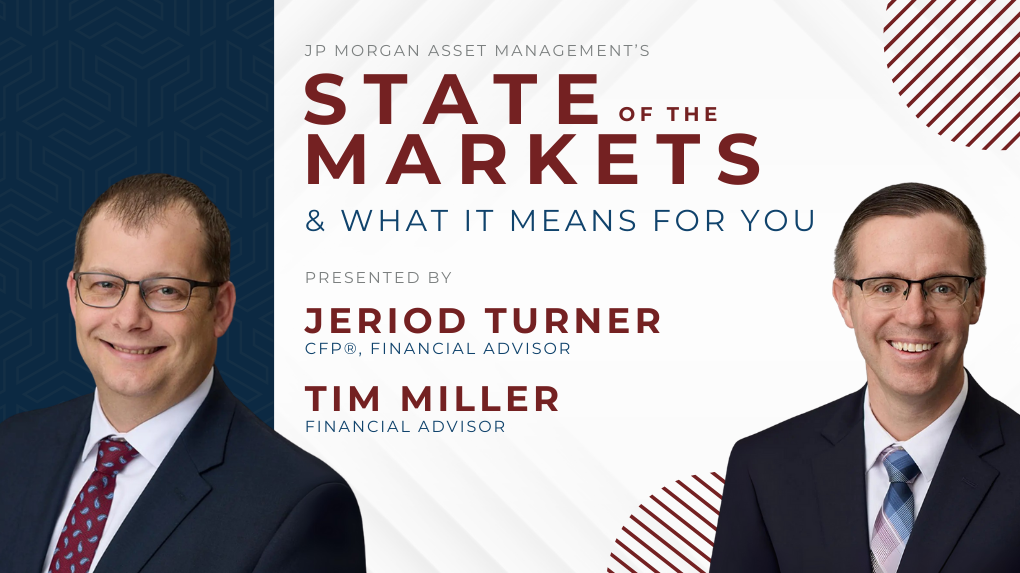

Are you joining our September Seminar?

State of the Markets & What it Means for You

We still have a few spaces left for our September Seminar! Gain clarity on today’s market dynamics and what they could mean for your financial future. This insightful session, presented by Financial Advisors Jeriod Turner and Tim Miller, will explore current economic trends, including inflation, interest rates, market performance, and potential policy changes as we look ahead to 2026. You'll walk away with a deeper understanding of the forces shaping the economy and how they may impact your planning.

/Upcoming Holidays & Closings

Happy first day of Autumn on September 22, 2025!