A Review of the 2024 Market

By Jeriod Turner, BFA™, CFP®, BFG Financial Advisor

The economy ended last year strong, growing at 3.1% in the third quarter, which was better than expected. Unemployment is still low at 4.2%, but inflation remains high at 3.3%, above the Federal Reserve’s target of 2%.

The Stock Market Performance

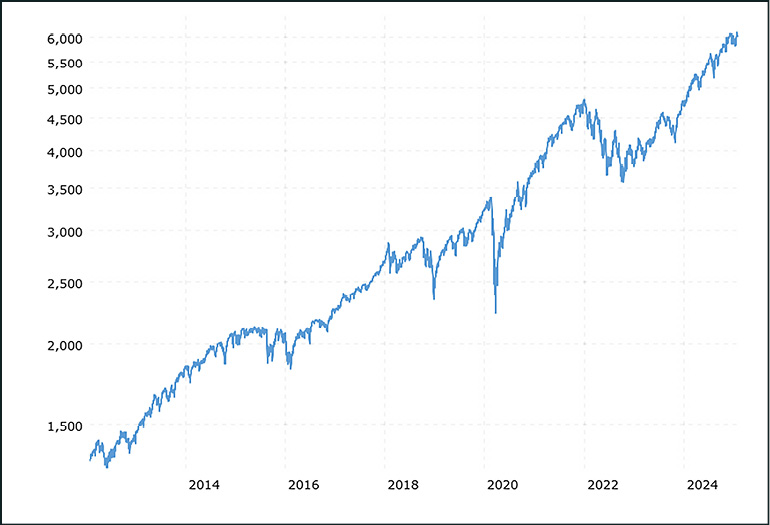

The stock market had a great year in 2024, with the S&P 500 (a group of the 500 largest companies in the U.S.) gaining more than 23%, with a total return of 25% (including dividends). The S&P 100, a smaller group of the largest and most established companies within the S&P 500, also saw strong growth, largely driven by technology and communications stocks.

There were 57 record highs in 2024—the fifth-highest number since 1957—with no major market declines. A major contributor to this success was a group of seven large tech companies, known as the “Magnificent Seven,” which included companies like Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, NVIDIA, and Tesla. They helped push up stock values, especially with the growth of artificial intelligence (AI)

Large vs. Small Companies

Larger companies, worth $10 billion or more, performed better than smaller ones. However, small companies still saw an increase of 14.4%, which is good news for those invested in them.

The Impact of the Election

Despite not seeing a “Santa Claus Rally” in December (a traditional year-end market boost from late December to early January), the market still saw a 3% increase after the election.

The markets reacted positively to federal changes, including tax cuts and less regulation, which are viewed as beneficial for economic growth. The Tax Cuts and Jobs Act from 2017, which brought significant changes to the U.S. tax code, including lowering corporate tax rates and modifying individual tax brackets, was set to end in 2025, but is now expected to be extended. This provided a boost for the market.

Bond markets saw a major fourth quarter selloff sparked by the election and the potential for stronger economic growth, inflationary policies, and more deficient spending in coming years.

Yields on the 10-year treasury note rose from 3.78% at the beginning of the quarter to 4.54% at the end of the year. The biggest losses came from long-term treasury bonds, which fell more than 8%.

On the other hand, Bitcoin made headlines post-election by soaring past $100,000 in value, drawing attention from investors.

Federal Reserve Actions

In December, the Federal Reserve reduced interest rates for the third time since September—totaling 1.0% in cuts in 2024 and bringing rates to a range of 4.25% to 4.5%. These cuts are expected to continue at a slower pace, with two cuts predicted in 2025.

Looking Ahead

Looking to 2025, the economy is still strong, but challenges remain. Inflation is still high, which may affect interest rates and economic growth.

On the global front, trade issues and potential tariffs (taxes on imports and exports) could create uncertainties. While tariffs have supporters who believe they help protect U.S. businesses, others worry that they may lead to higher prices for consumers and slow global trade.

Despite these concerns, technology continues to grow and brings new opportunities. However, investors will need to stay cautious as they navigate both the risks and opportunities that lie ahead in the year to come.

These views are those of the author, not of the broker-dealer or its affiliates. This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. All investments involve risk, including loss of principal. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Government bonds and Treasury bills are guaranteed by the US government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. Cryptocurrency and cryptocurrency-related products can be volatile, are highly speculative and involve significant risks including: liquidity, pricing, regulatory, cybersecurity risk, and loss of principal.