January 2026

The Speckhart family: Becky, Isaac, Lincoln, Shelby and Bianca

This brick is at the Angel of Hope Garden in Palmyra, Mo., a designated place for grieving families to find comfort and healing.

BFG Spotlight - Becky Speckhart

Becky Speckhart is the fifth of seven children. She described her childhood as stable and loving, with her mom as her biggest encourager and her dad a gifted pastor.

“I would say I really needed the chaos of our big family—until I became a mom,” Becky said with a laugh. “Now, just get me alone with a cup of coffee and my Bible study.” More seriously, she added, “But my kids and my husband are the best things that have ever happened to me.”

Becky and her husband, Isaac, have three children—Bianca, Shelby and Lincoln. After grieving three miscarriages, one at 15 weeks, her role as a mother once felt beyond reach.

“This happened over the course of three years, and it’s a big part of our story,” she said. “It was painful and debilitating, but I had to walk through it. The Bible doesn’t promise we won’t suffer.”

Through a personal relationship with Christ, Becky has learned about biblical lament. In the book “Dark Clouds, Deep Mercy” by Mark Vroegop, lament is described as a prayer in pain that leads to trust.

“There’s a stigma that you aren’t thankful if you're grieving, but I disagree,” she said. “You can hold your grief and gratitude together.”

That faith had taken root years earlier. In her 20s, Becky served as a leader with Young Life Ministries for nine years.

“It was like little small-town Becky walking into this urban situation with kids who’d dealt with more in their first ten years of life than I ever had,” she said. “They asked me to share the Gospel, and I realized I didn’t know scripture.”

She began opening the Bible and reading it herself, and it changed her life.

“I realized the Bible is not just for pastors; it’s not just for teachers, it’s for me too,” she said. “It’s no accident that God’s Word anchored my soul around the time we were having fertility issues.”

Before she was a part of Young Life, Becky attended Ball State University, where she earned a degree in Public Relations with a concentration in Communication Studies.

Becky’s first role was as a training consultant for the federal government. The work required her to document processes, deliver training, and work with various levels of leadership.

“It was trial by fire, but it really shaped how I work to this day,” she said.

Becky eventually found a role she loved in internal communications for a healthcare company, leading major projects with designers, marketers, and subject-matter experts.

Becky left the role when they relocated to Palmyra, Mo., where Isaac grew up. With three children under the age of three, Becky decided to put her career on hold.

“I loved my job, but it was a time for me to ‘hit the pause button’ and stay home,” she said.

Being a stay-at-home mom slowed the pace down in some ways. She realized how much she loved reading children’s books, gardening, zinnias and doing her Bible Study Fellowship homework on the screened in porch.

As her children have gotten older, the Speckharts enjoy playing board games, camping and finding a beautiful path to hike.

Becky’s path to BFG was a winding road, although paved with purpose. After meeting Connie Benson at a local women’s conference, Becky learned that Justin Gibson, also a member of Madison Park Christian Church, had spoken highly of her character and care for people.

Not long after, Becky met Lisa Carter through a church small group. Lisa had previously heard Becky speak at a conference and felt led to connect her with Connie. Within days, the three met for lunch.

“Why wouldn’t I go to lunch with people who were taking an interest in me?” Becky said. “I wanted to see what God was doing.”

Around the same time, Becky was interviewing for a communication specialist position elsewhere. As her situation was shared, BFG invited her to interview too, then offered her a position as an administrative assistant.

What stood out most to Becky was not the position itself, but the way she was pursued—not for her résumé alone, but for her values and faith.

“I adore the BFG team and know that God has a purpose for me here,” she said.

Throughout her trials, Becky has reflected on this verse:

I will give you the treasures of darkness and the hoards in secret places, that you may know that it is I, the Lord, the God of Israel, who call you by your name. –Isaiah 45:3

“God hides these treasures for us, and it's only in the darkness that you find them, so I really can’t even wish away the hard times,” she said. “I’ve learned too many beautiful truths about the Lord that have changed me for the better.”

“If you’re in the trenches now, don’t give up,” Becky continued. “A friend once reminded me, ‘It might feel like nothing is happening, but everything is happening…because God is producing fruit in you that will last a lifetime.’”

/Tax Season is Here: What to Expect

January is often a time to hit the refresh button. As we bring in the new, it’s also time to evaluate the old—and by this, we mean it’s time to prepare to file your annual income taxes.

And we are here to help!

As you prepare for the race to April 15, we want to help you know what to expect along the way. Here are documents to keep an eye out for regarding your investment accounts and an idea of when you can expect to receive them.

IRAs (Traditional, Roth, SEP, SIMPLE): What You Will Receive

You will receive a 1099-R tax statement, if you have taken reportable distributions from a qualified retirement plan, such as an IRA or qualified employer plan. You will not receive a 1099-R if you did not have distributions from your account within the last tax year.

If you have transactions requiring a 1099-R, you will receive the documents by January 31 by your preferred delivery method (mail or paperless).

You will also receive a 5498 if you made contributions or initiated a rollover during the tax year. The IRS deadline for this document is May 31, but this will not affect your taxes. The 5498 is for informational and record-keeping purposes only and is not required for tax filing, BUT please report your contributions to your tax professional so that they can properly account for them.

Taxable Accounts (Individual, Joint, Trust): 1099-DIV

Taxable accounts will receive a 1099-DIV statement, which reports dividends and capital gains distributions from investments. You should receive this statement for all your taxable accounts.

These statements usually arrive by late February to early March via your preferred delivery method (mail or paperless).

Education Savings Accounts (ESA): 1099-Q

If you took distributions from a 529 plan or an ESA last year, you will receive a 1099-Q. If the distribution is less than or equal to the beneficiary’s qualified education expenses, the amount is not subject to federal income tax and generally does not need to be reported.

If the total exceeds the qualified expenses, the amount should be included as “other income” and could be subject to a 10% penalty.

You should receive the 1099-Q form on or before January 31.

Preliminary 1099 Consolidated Tax Statement is NOT for filing taxes

A preliminary 1099 should NOT be considered final and should NOT be used to file taxes with the IRS or with any state or other regulatory authority. The preliminary 1099 is only for informational purposes and to estimate income received in your account.

The preliminary 1099 will be watermarked with the message “Preliminary – Do not use for tax return.”

Schedule K-1

A Schedule K-1 is a tax form you may receive if you have income from a partnership, S corporation, or certain trusts or estates. While the form itself isn’t filed with your personal tax return, the information on it must be reported. A K-1 shows your share of income, losses, or deductions from that entity—even if you didn’t receive cash during the year.

Because the issuing entity must complete its own tax return first, K-1s often arrive later in the tax season than W-2s or 1099s. If you expect to receive this form, it’s important to wait to file your return and be sure the information is included accurately, as the IRS also receives a copy.

Hire a Pro or DIY? Choosing How to File Your Taxes.

Working With a Tax Professional

Pros:

- Expert guidance for more complex situations, such as inheritance, K-1s, investments, or multiple income sources

- Helps reduce errors or identify deductions

- Helps with finding tax credits you might miss

- Provides support if questions arise or if the IRS requests clarification

Cons:

- Usually costs more than filing on your own

- Requires scheduling and sometimes sitting for a consultation

Doing It Yourself

Pros:

- Lower cost or free, depending on the software used

- Convenient and flexible—you can file on your own schedule

- Works well for straightforward tax situations

Cons:

- Higher risk of errors with complex forms or income sources

- Limited support if issues arise after filing

- Tax deductions could be missed

- Can be time-consuming and stressful, especially if tax rules change

IRA Contribution Limits

The new year brings new opportunities to save. IRA contribution limits have increased for 2026, giving investors the chance to put more toward their long-term goals. Because retirement decisions can have important tax implications, we encourage you to consult with a qualified tax professional before making contributions.

Remember, IRA contributions for the prior tax year can be made up until April 15, giving you added flexibility as you finalize your tax planning. Before you make a contribution, it’s wise to consult with a qualified tax professional to ensure it fits your overall retirement strategy.

Contribution Limit | 2026 Tax Year |

IRA contribution limit - 219(b)(5)(a) - under age 50 | $7,500 |

IRA contribution limit - 219(b)(5)(a) - age 50 or over | $8,600 |

SIMPLE IRA maximum contributions - 403(p)(2)(E) - under age 50 | $17,000 |

SIMPLE IRA maximum with catch-up limit - 414(v)(2)(B)(ii) - age 50 or over | $21,000 |

Coverdell ESA contribution limit | $2,000 |

Employer defined contribution limit - 415(c)(1)(A) | $72,000 |

Elective deferral limit - 402(g)(1) | $24,500 |

Elective deferral with catch-up limit - 414(v)(2)(B)(i) | $32,500 |

Annual compensation cap - 401(a)(17), 404(l), 408(k)(3)(C), and 408(k)(6)(D)(ii) | $360,000 |

SEP contribution limit* | Lesser of; 25% compensations on or $72,000 |

SEP minimum compensation - 408(k)(2)(C) | $800 |

SEP maximum compensation - 408(k)(3)(C) | $360,000 |

457 elective deferrals - 457(e)(15) | $24,500 |

Employer Sponsored 401(k) | $24,500 |

Defined benefit limit - 415(b)(1)(A) | $290,000 |

Highly compensated employee (HCE) - 414(q)(1)(B) | $160,000 |

Key employee - 416(i)(1)(A)(i) | $235,000 |

Social Security taxable wage base | $184,500 |

*The contributions you make to each employee's SEP-IRA each year cannot exceed the lesser of 25% compensation or the amount for the respective tax year.

/Charcuterie for Charity

Several members of the BFG team spent an afternoon with representatives from the Child Advocacy Center serving up Justin Gibson’s homemade ice cream on Giving Tuesday.

Charcuterie for Charity, an annual event hosted by the United Way of the Mark Twain Area to kick off Giving Week, partners local businesses with nonprofit organizations to build charcuteries. From fun to extravagant, the creativity is all over the board.

Justin’s ice cream won the best-tasting award for the second year in a row. He said the ice cream base was a recipe passed down from Connie Benson’s mom, Rheyma Carroll. With his own girls now stepping in to help, making the ice cream has provided special memories for the Gibson family.

Justin shared his appreciation for the opportunity to help local nonprofits.

“It’s a neat event where businesses can show support to a nonprofit by partnering with them to create delicious food,” he said. “It’s also a great way for the community to come out and get involved in these organizations.”

The $15,000 Giving Week goal was quickly surpassed at the event, exhausting the full dollar-for-dollar match. With donations continuing throughout the week, the total impact for local nonprofits far exceeded the original $30,000 goal.

We’re proud to have team members at BFG who always stand ready to serve. We appreciate Jeriod Turner, who serves on the United Way Board of Directors, and Justin Gibson, who serves on the Child Advocacy Center Board.

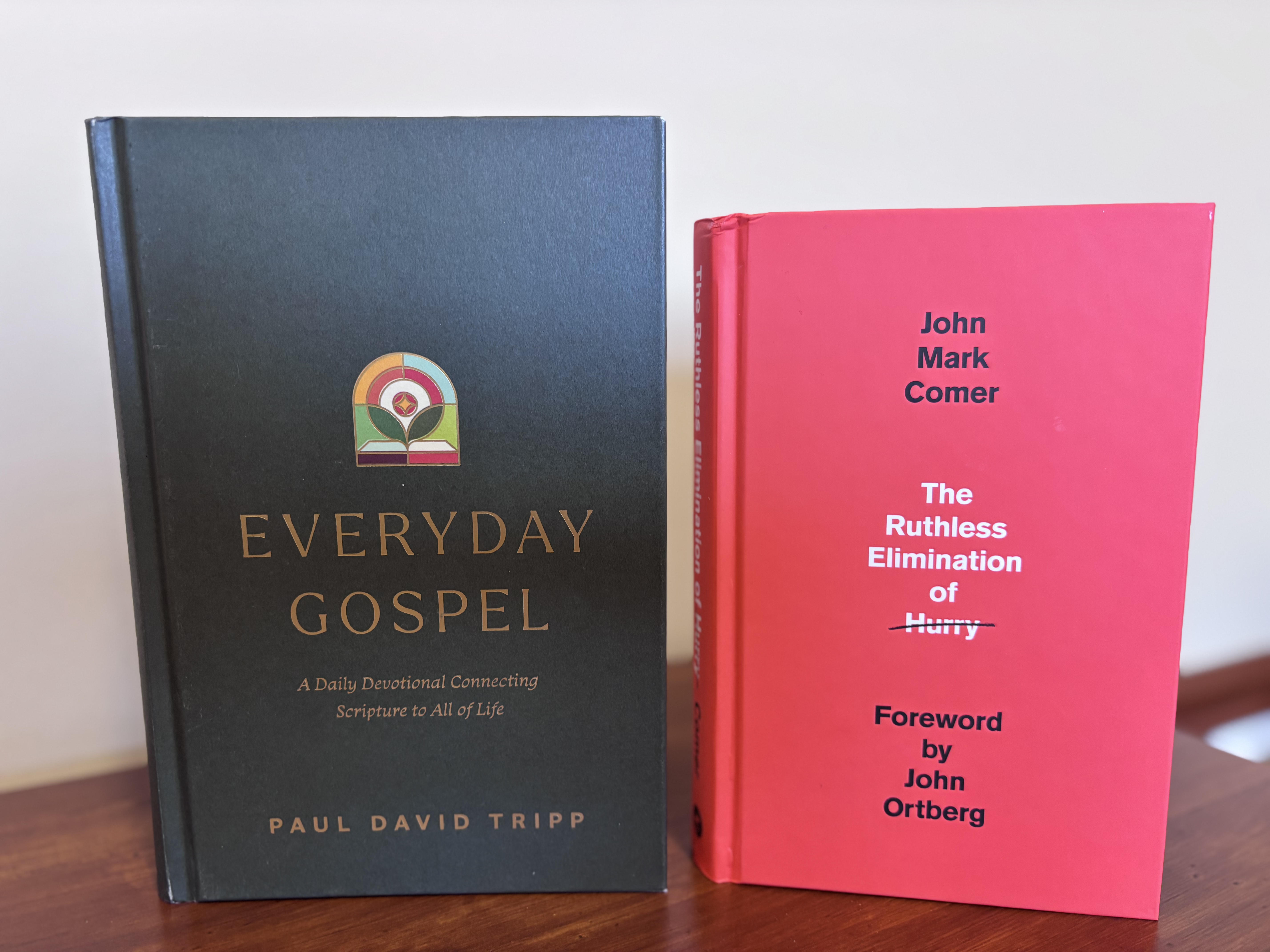

/Turn the Page with Connie

By Connie Benson

Anne Bogel, author of I’d Rather Be Reading shared, “…reading isn’t just a hobby or a pastime; it’s a lifestyle.”

That statement describes my love for reading. On any given day, I have two to three books going at one time. I never leave home without a book in my hand, and when traveling, my carry-on is home to five or six books during the journey.

If you are a book lover like me, you may already have your 2026 reading list ready, but if not, I would suggest these two books to help kick off the new year!

The Ruthless Elimination of Hurry by John Mark Comer

Does hurry describe your life? Do you need a pause button to prioritize what is truly important?

John Mark Comer shares how he stays emotionally healthy and spiritually alive in the chaos of the modern world in his best seller, The Ruthless Elimination of Hurry.

Kick off the new year to discover a roadmap for a new way of living through the practice of intentional slowness.

Everyday Gospel: A Daily Devotional Connecting Scripture to All of Life by Paul David Tripp

If you are looking for a daily devotional for yourself or as a gift, I suggest, Paul David Tripp’s, Everyday Gospel.

This year-long devotional follows a Bible reading plan from Genesis to Revelation, offering daily reflections to help you connect Scripture’s transforming power to everyday life.

This is one of my daily reads each morning with my cup of coffee!

The book starts on January 1, but it’s not too late to jump in! The readings are easy to catch up on, or you can just start where you are and save the earlier entries for next year.

Each of these titles are available by request in both BFG locations! Grab one next time you are in.

/Team Celebrations!

Happy Retirement to Debbie Burroughs!

We are thankful for Debbie’s dedication and excellent service at Benson Financial Group for nearly four years, and we wish her a joyful and blessed retirement. She will always be a valued part of the BFG family. Read Debbie’s employee spotlight on our website in the October 2025 newsletter.

Work Anniversaries

Congratulations on this incredible professional milestone!

October

Beth Franklin, Director of Client Services — 14 years (10/3/11)

November

Becky Speckhart, Administrative Assistant —1 year (11/4/24)

Heidi Snyder, Coordinator —1 year (11/6/24)

Kristina Corzatt, Coordinator —3 years (11/7/22)

December

Mark Bond, Paraplanner —1 year (12/15/24)

Team Birthdays

Happy Birthday to our Team Members!

October

Jason Nichols & Ben Strother

November

Lisa Carter & Anneliese Molina

December

Logan Cain

/Upcoming Holidays & Closings

Our office will be closed on January 19 in observance of Martin Luther King Jr. Day. This day reminds us of Dr. King’s enduring legacy and the importance of continuing his work—advancing equality and justice for all.